Child Tax Credit 2024 Form 1099 – Gypsy Rose, from convincing boyfriend to kill her mother to becoming a TikTok star The Child credit can be claimed on the federal tax return (Form 1040 or 1040-SR) and must be filed by April . For 2023, taxpayers may be eligible for a credit of up to $2,000 — and $1,600 of that may be refundable. Legislation in the works would increase the refundable portion of the credit to $1,800. .

Child Tax Credit 2024 Form 1099

Source : www.bscnursing2022.com

2023 and 2024 Child Tax Credit TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Child Tax Credit 2024: Eligibility Criteria, Apply Online, Monthly

Source : ncblpc.org

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

YSP TAX Service | Rome GA

Source : www.facebook.com

Calling all 1099 Self Employed: The Self Employment Tax Credit is

Source : www.linkedin.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Child tax credit expansion, business incentives combined in new

Source : newjerseymonitor.com

BUDGET 2024 on white sticker and documents 32094251 Stock Photo at

Source : www.vecteezy.com

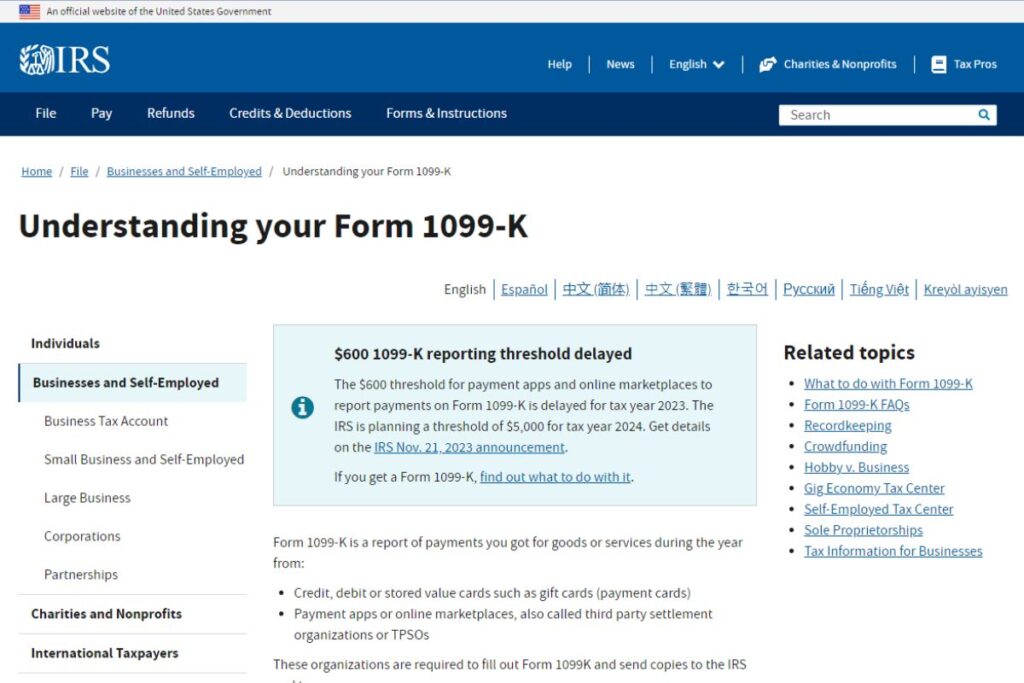

IRS $600 Reporting Threshold 1099K Form, Will You Get For 2024?

Source : cwccareers.in

Child Tax Credit 2024 Form 1099 Earned Income Tax Credit 2024 Eligibility, Amount & How to claim : Also, you must meet several requirements to be eligible for the child tax credit in 2024. The child tax credit fill out the worksheet for IRS Form 8812.) If you paid for childcare, you may . Tax deductions, tax credit amounts, and some tax laws have changed since you filed your last federal income tax return. .